Inheriting An IRA

April 5, 2022

April 5, 2022

Proverbs 13:22: “A good man leaves an inheritance to his children’s children.” (NKJV)

Inheriting anything is such a blessing. I remember when my mother-in-law Debbie died suddenly how much of a blessing and a shock it was to my wife to inherit a little bit of money. Not much, mind you, but it was so much more than we were expecting. Knowing that someone loved you enough to save or set aside a little bit of something just for you is heartwarming. What an honor to receive such a gift!

I often work with people who are driven to a financial planner when they receive a gift from a deceased loved one. The grief is real, but there is almost always a fondness shared by the beneficiaries for the one who left them something behind. The question that naturally comes up after grief and gratitude is “How do I steward this gift wisely?” That’s what I’d like to answer today, specifically regarding Inherited IRAs.

IRAs are treated differently than many other gifts (I’ll write in more detail about capital gains and inheritance of “non-qualified” assets later). IRAs are tax-savings vehicles that incentivize people to save for retirement by promising a tax-break. You can have a brokerage account that is an IRA, a CD that is an IRA, an annuity that is an IRA, a money market account that is an IRA, a mutual fund account that is an IRA, and other forms of IRAs but the common denominator is that the IRS isn’t going to count contributions to that account (as long as they qualify) as income for the year you make them and you won’t be taxed on the growth/gains in that account until you take the money out (so long as you follow all the rules).

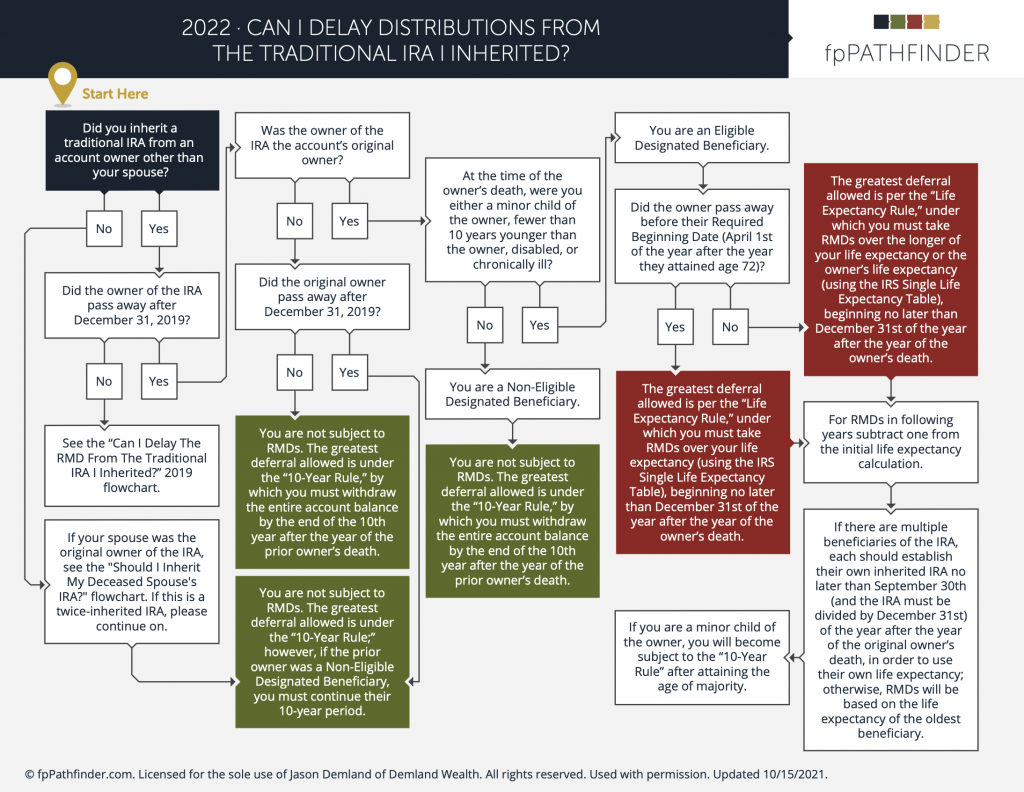

Recently there have been some changes made to how inherited IRAs work and many words have been written and many questions have been asked (and still are being asked) of the IRS about how this is all going to work out after the SECURE act passed in 2019. Usually unless you are an Eligible Designated Beneficiary your only option is to take out the entirety of your beneficiary IRA by the end of the 10th year after the year of the prior owner’s death. This is what is known as the 10 year rule. You can take it all out evenly, all at once, or wait until the end of the 10th year to take it out, but it must be emptied by the end of that 10th year. There is a small caveat in this rule, if the decedent died after their Required Beginning Date (when they needed to take RMDs) you may be able to use the old “stretch” provision. That’s pretty simple really, but figuring out which method will work best for your situation takes a lot more analysis. That’s because distributions from an inherited IRA will count as ordinary income and could cause you to fall into a higher tax bracket. It’s very important to have a plan to maximize your inheritance and keep the IRS from getting more than its fair share.

If you are an Eligible Designated Beneficiary (Surviving Spouse, Disabled, Chronically Ill, less than 10 years younger than the decedent, a minor child, and some “see-through” trusts) then you may be eligible to stretch the distributions out over your lifetime according to a table. This is sometimes more favorable than the 10 year rule and needs to be investigated thoroughly if it’s a possibility.

This has been just a short intro into what to do with an inherited IRA and a flow chart would be incredibly valuable in this scenario. Hey. I’ve got one. Check this out! If you have more questions reach out to a qualified professional for your specific scenario.

Join my newsletter and get biblical financial inspiration.

Demland Wealth LLC (“DW”) is a registered investment advisor offering advisory services in the State[s] of OH & IN and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Demland Wealth LLC (referred to as “DW”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute DW’s judgement as of the date of this communication and are subject to change without notice. DW does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall DW be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if DW or a DW authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.