How To Plan To Not Run Out Of Money In Retirement

May 27, 2022

May 27, 2022

There are many credible ways to solve one’s retirement income puzzle, but the right starting point is the one that is aligned with clients’ preference (or the client won’t be comfortable sticking with the strategy, anyway!

Alex murgia & Wade Pfau

https://www.kitces.com/blog/risa-framework-retirement-income-planning-client-preferences-total-return-strategy-risk-tolerance/

It feels different and almost wrong for many folks. The numerous clients I have helped through retirement have all felt it to varying degrees. It’s a strange feeling to stop bringing home a paycheck and to start to deplete the nest egg that took 30 years to accumulate.

After all, disciplined saving over 30 years is no accident. It takes hard work and effort. It takes self-denying sacrifice and determination, and now that you’re approaching that often dreamed of time when you can stop working because you have to and start working only when you want to, you start to feel nervous and start asking questions like:

“What if I run out of money?”

“What if I lose all of my money in a new Great Recession?”

“Is the money I saved really going to be enough?”

“How can I be sure I’m making the right decision?”

Those are good questions and those uncertainties are the reason having a great retirement income plan as part of your overall financial plan is so important. But how do you know you have the right plan?

There are lots of options to choose from and lots of financial professionals out there selling you their “best” product to answer your questions, but there is no one solution that fits everyone. Each individual may have their preference for how to protect and generate retirement income for folks and think their way is the best (I know I think my way is best!) but it’s more complicated than that.

An important and often overlooked factor in financial planning in general, but especially in retirement income planning is plan adherence. How likely is it that you will stick to the plan?

If you’re uncomfortable, unfamiliar, or untrusting of the stock market and are banking on 30 years of annualized returns greater than 6% how likely are you to stay invested when your $500,000 equity portfolio dips by $150,000 (30%) or when it doesn’t grow at all for a few consecutive years?

Alternatively, what if you’re a analytically minded investor who is comfortable taking risks and seeing the long-term history of the markets. How likely are you to stick with an income protection plan that locked in your portfolio to 3-7% “guaranteed” returns (as long as you stay invested for 5,7, or 10 years) when the stock market is ripping off double digit returns year after year?

Unfortunately these types of plans are sold to the wrong type of people all of the time, and it results in locking in losses, paying high surrender fees, and a festering hatred for all financial advisors everywhere.

I have often told investors “Your risk tolerance doesn’t matter!” and I stick by that. Your tolerance won’t determine the returns of the stock market. Your tolerance to risk won’t change the contract on a variable annuity. But where it does matter is in whether or not you’ll stick to the plan.

In psychologist Dr. Moira Somers book Advice That Sticks she likens planners giving financial advice to doctors giving medical advice. The recommendations may be spot on and very likely to result in a positive outcome, but for some reason patients (clients) just don’t implement the plan.

When’s the last time you saw a doctor? How well did they get to know you before prescribing or diagnosing you? Without going in to too much commentary on today’s medical industry, I think it’s safe to say that most of us would prefer our doctors to take a lot of time to understand us (the best ones already do!) so they can prescribe a course of action that will not only make us well, but one that we’ll adhere to.

In finance it’s similar because as an experienced and educated financial planner I can easily see what needs to be done and how to increase the likelihood of success (how success is defined is a worthy of many more words than this) and then prescribe a course of action. But if I disregard my clients’ personal experience, values, and psychology then my recommendations are doomed to fail, because the client is bound to not adhere to the plan.

Well, I couldn’t let it completely go. Your preferences don’t matter in some other ways.

Expanding on the conundrum physicians face when treating patients, it’s clear that to some extent our preferences don’t matter. If I prefer to eat 1,000 grams of sugar every day it makes it really hard for my doctor to help me avoid type 2 diabetes. They may prescribe insulin to keep me from killing myself, but at that point they’re just doing damage control to the best of their ability.

Similarly in retirement income planning I may have a hard time coming up with solutions if a clients’ preference is to not take on any risk, not commit to any length of time, and get the top returns available in the market, and also retain maximum flexibility. That’s not the way it works.

Finance is math and math is a beautiful gift from God. There are rules in math that we can learn and follow. We can replicate results and forecast future results.

As a financial planner once I know your values, goals, dreams, desires, behaviors, and experience I’ll have a good idea of where we are going. That’s the hard part. The math is the easy part because it’s not fluffy, the math doesn’t change.

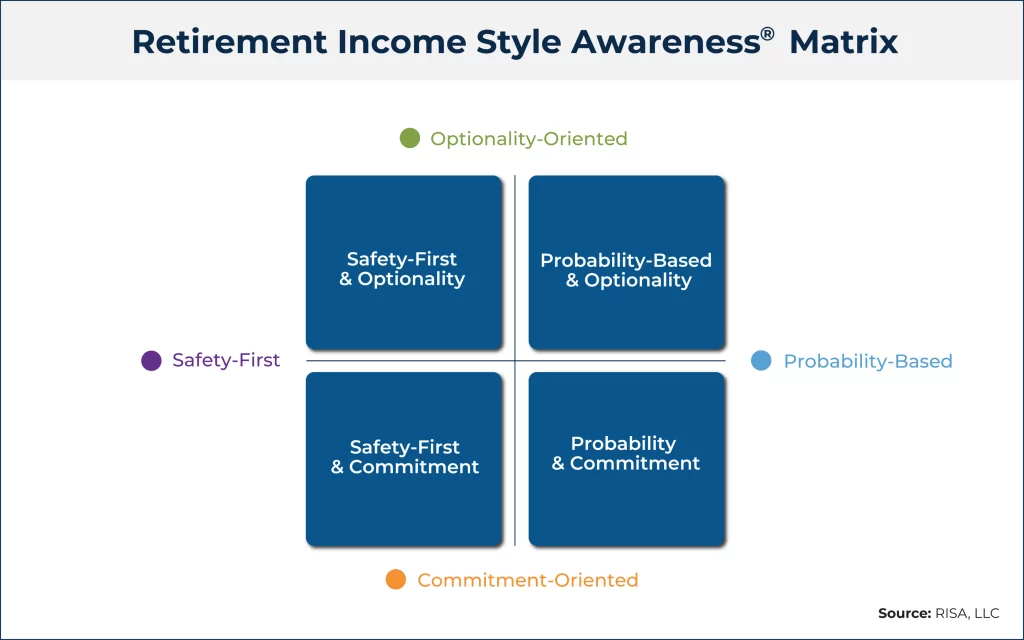

Using the RISA framework developed by Alex Murguia and Wade Pfau it’s a little bit helpful to dive into some different income style personality types that many people exhibit. Murguia breaks down the styles into a matrix that has a mash-up of these 4 styles: Safety First and Probability Based and Optionality Oriented and Commitment Oriented.

Probability-Oriented investors rely on history and statistics and usually invest in a way that is usually considered aggressive and seek higher returns.

Optionality-Oriented investors usually use income producing tools that retain ultimate flexibility and don’t lock them into anything.

Safety-First investors prioritize preservation of their assets above all else.

Commitment-Oriented investors place the highest premium on getting guarantees.

You may look at these options and see yourself fit into one of the four boxes shown below:

Knowing the style of income that you prefer can go a long way toward developing a plan that suits you best. Since the goal of retirement income planning isn’t usually to die with the maximum amount of money possible but is rather to maximize enjoyment of life, there are lots of other inputs to consider in income planning apart from how to grow the money the best.

I have undone a lot of other financial advisors work for clients because there was a communication breakdown between what the client needed/wanted and what the advisor ultimately recommended. It’s really important to have a sound income plan in retirement that you can adhere to. In order to do that, you need to understand it and be comfortable with it.

But that’s not all. The plan also has to work, and that’s where the math comes in.

Join my newsletter and get biblical financial inspiration.

Demland Wealth LLC (“DW”) is a registered investment advisor offering advisory services in the State[s] of OH & IN and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Demland Wealth LLC (referred to as “DW”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute DW’s judgement as of the date of this communication and are subject to change without notice. DW does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall DW be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if DW or a DW authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.