Buckle Up

June 10, 2022

June 10, 2022

In March and in May the Fed raised rates .25 and .50 bps respectively. After the June 14-15 meeting they are expected to raise rates another .50 bps in an effort to curb the historic inflation numbers we are seeing.

Inflation is hurting our economy and the people that make up our economy. The Fed exists to limit the damage done by inflation.

The Federal Reserve has what’s commonly known as a “dual mandate” to keep inflation/prices reasonable and to keep unemployment from getting out of hand.

The Fed has many tools they can utilize to fulfill this mandate:

What everyone is looking at right now is the Fed’s Open Market Operations process. This is the method they use to impact the rate we’re all talking about all of the time. There’s a 12 person committee called the Federal Open Market Committee (FOMC) that sets the targeted rate and then uses open market operations, discount rates, and reserve requirements to impact it.

In May, 2022 rates were raised by another 50 basis points for a targeted level of .75-1.00. It’s expected that in June they’ll move up another 50 basis points for a targeted level of 1.25 to 1.50.

| Date | Increase | Decrease | Level (%) |

|---|---|---|---|

| May 5 | 50 | 0 | 0.75-1.00 |

| March 17 | 25 | 0 | 0.25-0.50 |

The idea is that this rate hike will help keep the economy from “overheating” with inflation rising quickly.

Will it work?

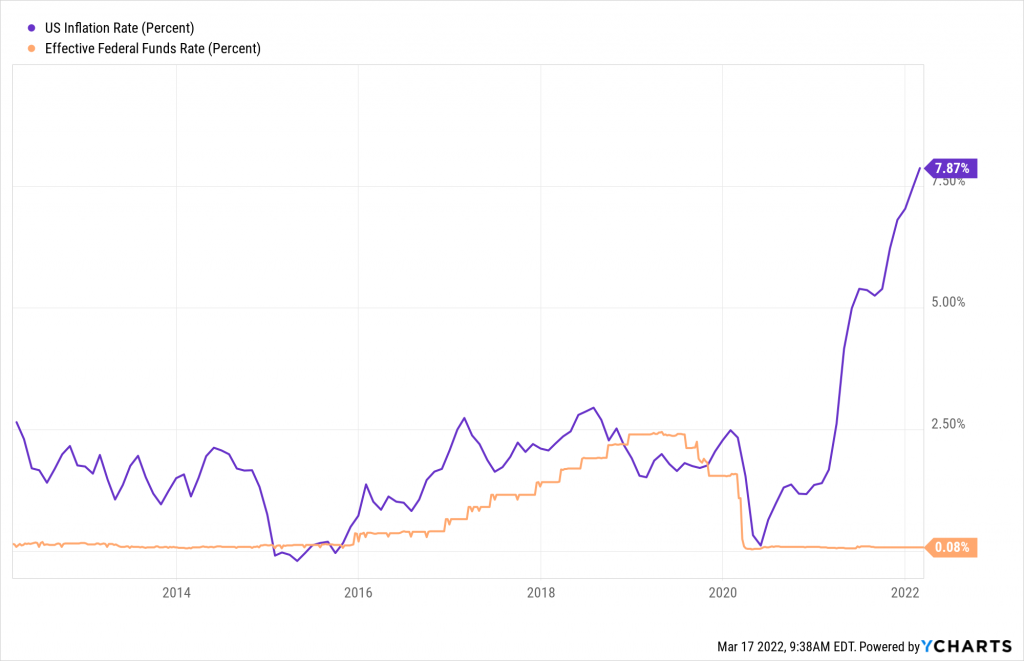

Historically it has, but so far the rate of inflation is far outpacing the fed’s response. Here’s what inflation vs. the fed funds rate has looked like lately:

Looks a little bit behind the curve doesn’t it? It’s even worse now that CPI rates came out at a staggering 8.6% for May 2022.

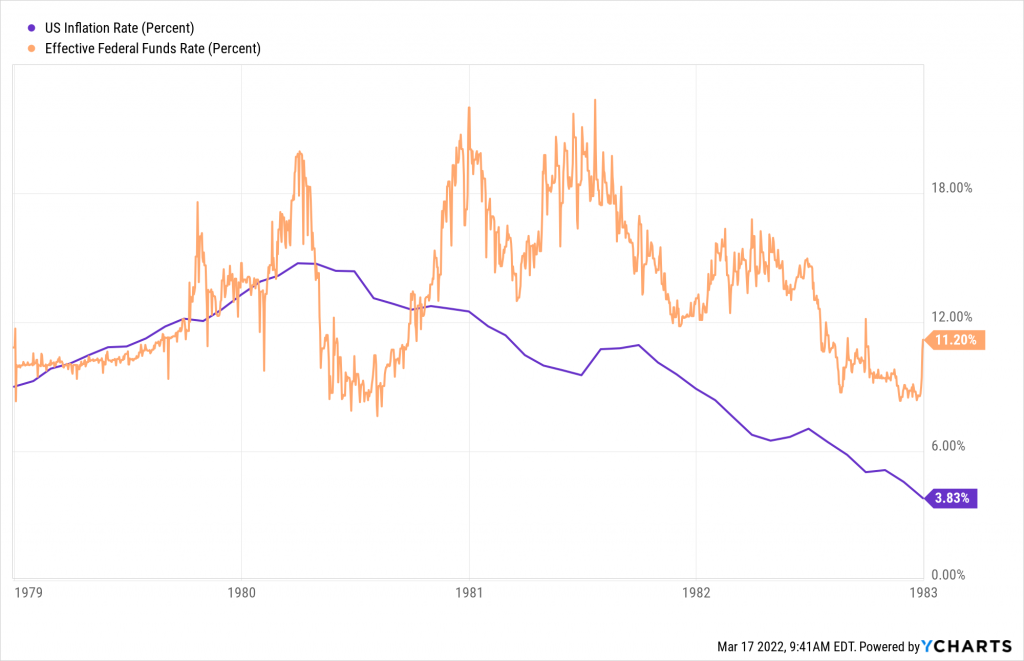

Contrast that image with what Fed Chair Paul Volcker did in the late 70’s and early 80’s to battle rising inflation:

Fed funds rates got up to 20% there in the early 80s to tamp down the extreme inflation that was taking place.

I don’t know why the Fed is being so dovish (I have my guesses) but this is a pretty concerning signal that we need to buckle up and be prepared for some less-than-ideal times as far as personal finance goes. Here are some action items you can start thinking about right now to be prepared:

Stocks are historically a great hedge against inflation and owning a home (with a low mortgage rate) is a great hedge also. Even better than that is being completely debt free and having the bulk of your money working for you in the form of investments, business, or real estate.

Above everything it’s important to not fear. Romans 8:28 says that “We know that all things work together for the good of those who love God: those who are called according to His purpose.” There have been worse times in history than this and they haven’t yet ushered in the apocalypse.

Remember that all we have belongs ultimately to the Lord and we are but stewards: “The earth and everything in it, the world and its inhabitants, belong to the LORD” Psalm 24:1.

We must remain steadfast and use the tools we have been given to make the best decisions we can without fear and without envy and greed.

Join my newsletter and get biblical financial inspiration.

Demland Wealth LLC (“DW”) is a registered investment advisor offering advisory services in the State[s] of OH & IN and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Demland Wealth LLC (referred to as “DW”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute DW’s judgement as of the date of this communication and are subject to change without notice. DW does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall DW be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if DW or a DW authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.