How To Take Advantage Of A Bear Market

June 17, 2022

June 17, 2022

We’ve entered the 26th bear market since 1928. All three major market indices are significantly lower than their highs, but just recently the S&P 500 (a major bell-weather for the U.S. stock market as a whole) has plunged more than 20% from its recent all-time high.

Stock market drops this large aren’t uncommon and the average bear market usually drops around 30% from the recent high. There’s no way of knowing how long it will last or how low it will go. Many investors use history as a guide and that can be helpful.

It’s reassuring to know that every single bear market the S&P 500 has had so far has been followed by a bull market where stocks increased significantly and has more than made up for the losses. It’s reassuring to know that the average length of a bear market is a little more than a year, and if that’s the case we’re already half-way through the damage (though like I said, there’s no way to know how long this will last).

Since we are powerless to change the market with our worrying, it’s important to focus on ways to take advantage of this bear market. Here are 3 ways to make the most out of this stock market drop.

Inflation is currently at record highs. Cash sitting in the bank, in your 401(k), in your safe at home, and even in your wallet is losing value (purchasing power) at a blistering pace. Cash may be usually king, but right now putting cash to work is king.

The stock market has dropped over 20% from it’s highs. That means that if you held a diversified portfolio of equities and had $1,000,000.00 invested in the market it is likely worth somewhere around $800,000.00 right now. That drop of $200,000.00 may feel like a loss, but it’s not a loss in cash. It’s a loss in valuation. Much like if the value of your home were to drop, if you don’t sell it you don’t realize the loss.

If you were comfortable putting money to work (e.g. investing) while the stock market was increasing week after week and day after day for the past 2 years you should be more than happy to put money to work now when the value has dropped back to what it was about 18 months ago. Market drops present wonderful buying opportunities that we should take advantage of but are often hesitant to because when the market goes down, we tend to fear that it will keep going down.

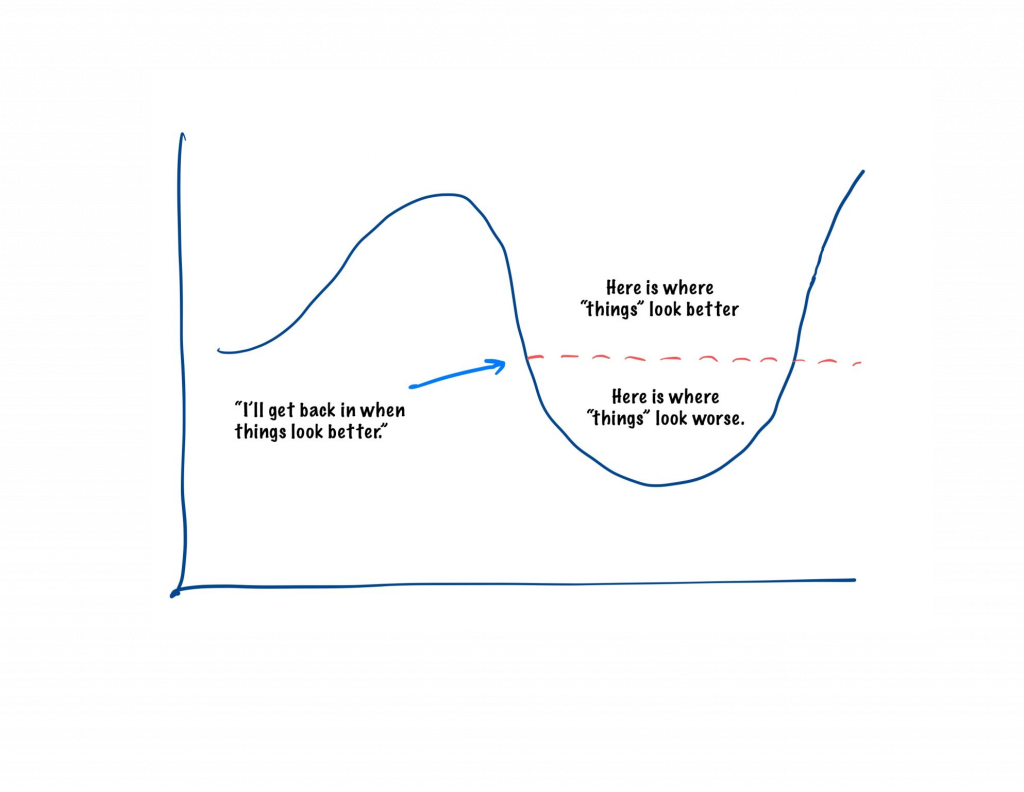

If we wait for the market to come back up before investing, we are falling victim to the trap of trying to time the market, which cannot be done. Psychologically it’s really hard to get past this, because it seems like a good idea to wait until things feel good again, but there’s a problem with that.

Graig Stettner, CFA came up with a wonderful sketch that illustrates this:

The best option is to keep investing, no matter what happens. Knowing that we’re significantly off of the market highs is indicative of a great opportunity to invest, because of what we see usually happens after a market downturn. History does not always repeat exactly and past performance is not a guarantee of future results, but we can reasonably expect what is happening now to at least be similar to what has historically happened. Dimensional Funds released a helpful chart showing market returns 1, 3, and 5 years after market drops of 10%, 20%, and 30% respectively.

How should you consider putting your cash to work? Well, first think about making contributions to your retirement plans. You can max out Roth IRAs if you qualify right now with cash you’re sitting on. You could also consider increasing your contributions to your work retirement plan. Don’t forget about investing your HSA dollars as well if you are eligible for an HSA. Even if the custodian your company chooses for an HSA doesn’t allow for it, you are able to transfer some HSA funds into another investable HSA. If you’ve maxed out all of your tax-advantaged investment options with excess cash, you should also consider investing in a non-qualified account. These are sometimes called brokerage accounts, or mutual fund accounts by some finance people, but really they’re accounts that are going to be subject to capital gains taxes instead of special retirement account rules.

Roth conversions are the transfer of pre-tax retirement accounts (e.g. Traditional IRAs, 401(k)s, SIMPLE IRAs, or SEP IRAs) into a Roth IRA. These transactions don’t incur a tax penalty but the account owner must pay taxes on the money that is converted as ordinary income for that year. Whether or not doing this makes sense for you is determined by a whole bunch of quantifiable and also qualitative data, so it’s very important to work with a CFP® or tax strategist that understands the pros and cons very well so you don’t end up paying more in lifetime taxes than you otherwise may have.

If you’ve determined that Roth conversions are a good part of your lifetime tax strategy then market pullbacks are a great time to implement them. This is because you have the opportunity to convert shares at a depreciated value in your traditional retirement account. The result is more shares converted with less taxes owed than if markets were higher.

Consider doing Roth conversions while the market is in bear mode to maximize tax savings over your lifetime.

When markets retreat in value it can be a great time to take advantage of some paper losses. Selling losing positions and buying a different position can allow for some income tax-reducing short and long term gains to be realized in your account. It’s important to understand wash-sale rules when employing this strategy, but if used correctly it can be a great way to offset capital gains or just reduce your overall taxable income for the year. Tax loss harvesting is a big silver-lining when stock values drop significantly.

Rebalancing is also vitally important during a bear market. If you have a 60/40 portfolio that is 60% equities and 40% fixed-income (bonds, cash, etc.) and there is a large drop in stock prices, then your investment mix isn’t 60/40 anymore. It could be closer to 50/50 or 40/60. Rebalancing is the act of moving some of the portfolio allocation from the side that held up better to the side that has suffered bigger losses. This is very similar to “putting extra cash to work” from earlier, but employed without using actual cash. A good portfolio manager or financial advisor will make sure this is being done for you.

Ultimately, what to do during a bear market has to do with stewardship. It is important to make wise financial decisions at all stages of market cycles and personal finance stages. Seek first the kingdom of God and remember that true wisdom comes from knowing the Lord (Proverbs 9:10). Remembering that God is in control no matter what offers peace and comfort to us as we methodically make our way through uncertain times. Don’t let fear paralyze you into rash or unwise decisions, trust Christ and be wise.

Join my newsletter and get biblical financial inspiration.

Demland Wealth LLC (“DW”) is a registered investment advisor offering advisory services in the State[s] of OH & IN and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Demland Wealth LLC (referred to as “DW”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute DW’s judgement as of the date of this communication and are subject to change without notice. DW does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall DW be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if DW or a DW authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.