Pay Less In Taxes in 2022

March 22, 2022

March 22, 2022

It’s tax season!

You and millions of other people are gathering documents smattered with seemingly random number/letter/hyphen combinations.

W-2 K-1 1099 1099-R 1099-DIV 1098 1098-T 1099-INT 1095-A W-4

It’s time to diligently document every dime you brought in and try to find every expense you can deduct.

If you still have to pay taxes after all of that sleuthing – then congratulations! You must have made money.

While it’s nice to know you’ve been a profitable and valuable contributor to the society that we live in by paying your fair share of taxes, I’m sure you’re wondering if you’ve paid too much. We all do. Whether it’s because we are wary of the wasteful tendencies of our federal government or because of the opportunity cost we feel because we’re sure we could do a better job helping ourselves with the thousands of dollars we’ve been taxed; every single one of us wants to be certain we’ve paid what we owe and not a dollar more.

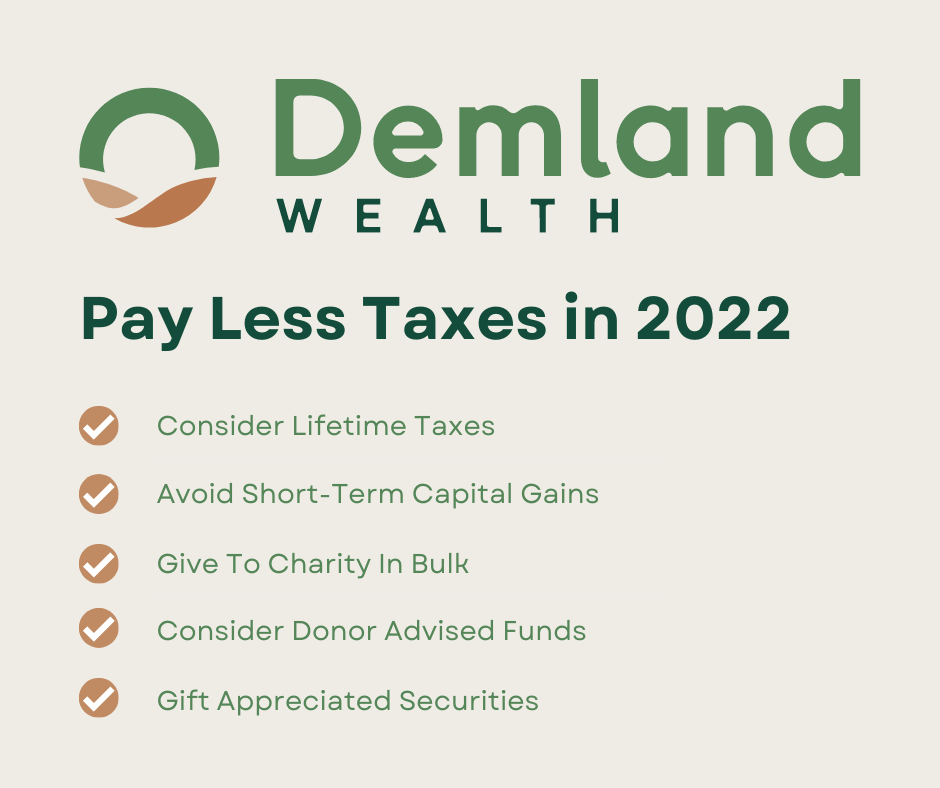

It’s our duty as responsible providers for our families to pay as little as legally obligated to our federal government. Our money is better spent on gifts for children and grandchildren, donations to our churches for buildings or other ministries, directly feeding the hungry, and caring for widows and orphans in our communities. If you agree with that then heed these 5 tips on how to pay less taxes in 2022.

This is just the tip of the iceberg as far as long-term tax strategy goes and the options get even more robust if you’re self-employed, have stock options, have other assets like farm ground that you may sell, and more. Remember to find someone who can help with taxes for more than just the current year for 2022 when you’re getting your 2021 taxes sorted out.

Join my newsletter and get biblical financial inspiration.

Demland Wealth LLC (“DW”) is a registered investment advisor offering advisory services in the State[s] of OH & IN and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Demland Wealth LLC (referred to as “DW”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute DW’s judgement as of the date of this communication and are subject to change without notice. DW does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall DW be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if DW or a DW authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.