If you give substantial amounts to charity every year then it’s extremely important to consider taxes. The reason for that is simple: The less you pay in taxes means that you have more to give!

I know many people that love to give generously to causes they are passionate about. Christians specifically can be enormously generous in their giving. With worthy ministries like their local church, foreign missions, and local ministries (e.g. community pregnancy centers, homeless shelters, battered women’s centers, fostering and adoption ministries, etc.) there are plenty of places worthy of receiving donations of your hard-earned money. Many of us give regularly to these ministries out of our ordinary income.

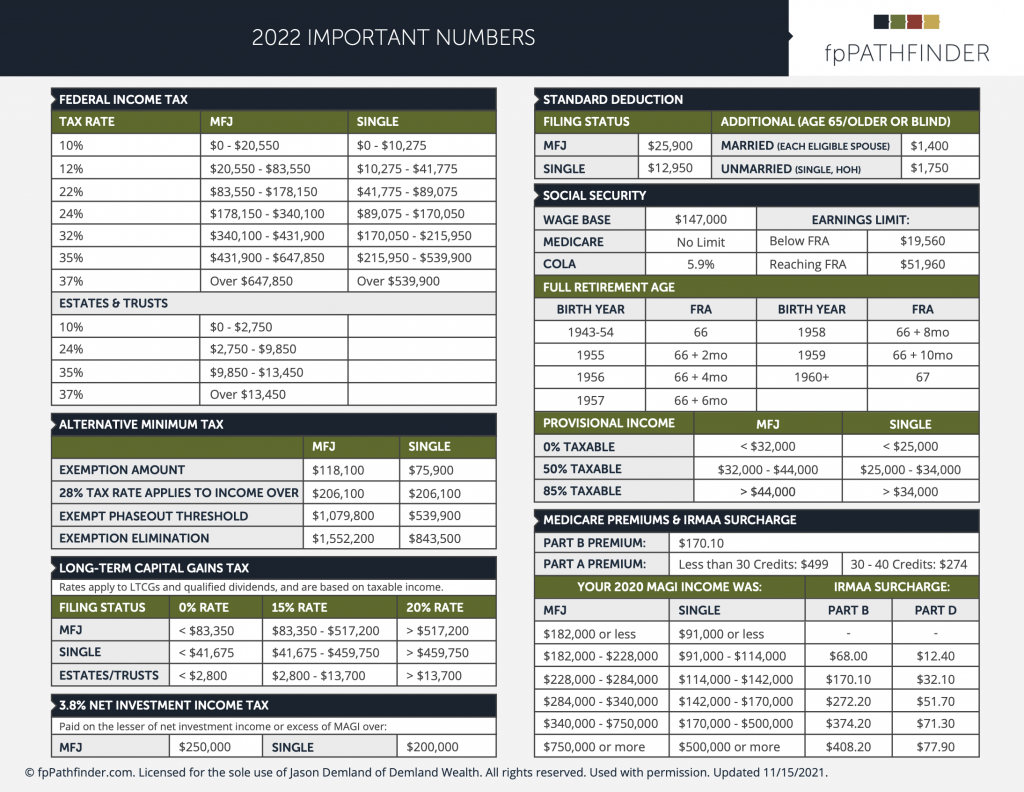

But what about a year where your income is especially high? This increase in income could be due to selling a business, selling a farm, getting a big bonus at work, or just be a result of the culmination of years of hard work bringing in a higher take-home than you could have ever dreamed of. Regardless of the reason for the increase, higher income usually results in higher taxes. Consult the table below to see just how much in taxes can be at stake when your income starts getting into the hundreds of thousands of dollars a year. It’s worth the time and energy to think about strategies to reduce your tax burden and increase your charitable giving.

Gifting Large Sums To A Donor Advised Fund Can Reduce Your Personal Income Taxes

Donating to a Donor Advised Fund works very much like donating directly to a charity would work. Gifts are limited by the IRS and the amount of your deduction is limited by your adjusted gross income for the year:

In general, contributions to charitable organizations may be deducted up to 50 percent of adjusted gross income computed without regard to net operating loss carrybacks. Contributions to certain private foundations, veterans organizations, fraternal societies, and cemetery organizations are limited to 30 percent adjusted gross income (computed without regard to net operating loss carrybacks), however.

https://www.irs.gov/charities-non-profits/charitable-organizations/charitable-contribution-deductions

But instead of giving the money (or stock or other items) to the charity directly, your donation is made to the Donor Advised Fund. You get the charitable deduction commensurate with the type of gift and AGI that you have, but the charity doesn’t get the money…yet. The donor advised fund can hold the donated funds to be granted to a charity at a later date. “Why would you do this?” you may ask. “Why not just give the money directly to the charity if that would get you the same deduction”? you continue to ask.

I have an answer.

Why Not Just Give Directly To A Charity

Giving generously is great and commendable. The Apostle Paul said in his second letter to the Corinthians “7 So let each one give as he purposes in his heart, not grudgingly or of [f]necessity; for God loves a cheerful giver”. With this in mind, it’s certainly a mark of faith to want to give. It’s also a mark of faith to exercise wisdom. If you know exactly how much and where you want to give then a donor advised fund may not be right and could be adding unnecessary complication to a simple situation. However, when you are presented with a larger income than normal and a subsequently larger amount of charitable giving than usual, it is important to do your due diligence on the organizations you want to support financially. I’ve heard many stories of “when helping hurts” and times when generosity was horribly abused. A donor advised fund supports taking some time before making lump sum donations to an organization while still realizing the maximum tax deduction in a given year. This way you can properly vet an organization and even give gradually to them. Here’s an example:

John usually makes about $150,000 a year in wages from his job and tries to donate at least 10% of his income to his church ($15,000 a year). John and his wife also support the local community pregnancy center with recurring gifts of $500 a month ($6,000 a year). They normally use the standard deduction when filing taxes since it is so high and they have few other deductions. However, this year John had an excellent year at work and will have around $500,000 in taxable income for the current year. If John and his wife want to maintain their effective charitable giving rate of 14% (15,000+6,000=21,000 / 150,000 = .14) they must donate a total of $70,000 this year.

But John and his wife are in a whole new tax bracket this year and will likely be in the 35% marginal rate. It’s also very likely that John’s annual pay will revert closer to his mean of $150,000 a year next year. In this scenario John and his wife can donate up to 50% of their AGI (approximately $250,000) and deduct it. This is great! But they don’t know where to give all of that money to. They know that the local community pregnancy center is in extremely good financial health and their local church just started talking about building a new facility. Instead of making a decision on where to donate the money right now John and his wife make a $250,000 donation to a donor advised fund so they can direct where the money is given at a later date while still lowering their taxable income with a $250,000 deduction.

John and his wife took their time vetting an orphanage ministry in Haiti and after a year they decided they’d use their donor advised fund to send $30,000 dollars a year for as long as it would last (according to a quick time value of money calculation using 6% interest that’s about 9 and a half years!).

In the previous example not only are taxes saved, but the value of the donated amount is increased because of the tax savings. At a marginal rate of 32% $250,000 becomes a gift of only $170,000. A reduction of $80,000! There’s also been a huge added benefit of flexibility, because now that the tax deduction has been realized in the current year you can take a breath and take your time to decide where to donate the funds to from the donor advised fund.

How To Use A Donor Advised Fund

Donor Advised funds are usually sponsored by another 501(c)3 that runs the fund. Investments from donors can be pooled inside the fund and then donor’s “advise” or request grants to be distributed from the fund to charities of their choice.

Some very large Donor Advised funds examples are Vanguard Charitable, Schwab Charitable, and Fidelity Charitable. There are also local area foundations like my town’s Defiance Area Foundation that can be especially helpful at recommending community resources that may need funding.

Donors can donate cash or appreciated stock to a Donor Advised Fund (gifting appreciated stock is an especially great way to add a “whammy” to your tax savings…making a double whammy). Once the funds are invested in the fund they grow tax-deferred and that’s beneficial for the eventual organizations that might receive the donations.

The donor advised fund usually has its own investment process, so that is something you’ll want to vet. The larger DAF providers (like Schwab) will allow you to have your own advisor direct your investments if you’re over a threshold (right now it’s $250,000 in the fund). Usually there is a minimum amount that must be contributed to the DAF (could be anywhere from $5,000 to $50,000 depending on the sponsor). It’s important to know what kind of organizations the DAF will distribute to as well, since they technically are the ones that get to decide (though if they deny a donor request they probably won’t get very many more donations). Usually any qualified charity will be available to give to. This is definitely an area that takes some research, so make sure to talk with your Financial Planner or C.P.A. about any strategy you may want to employ.

Happy Giving!