War, Inflation, and What To Do With Cash

March 15, 2022

March 15, 2022

We had a decades long break from war, but now in the words of Aragorn to King Theoden: “Open war is upon you, whether you would risk it or not.”

It comes as quite a shock to many of us that we are living in a troubled world. The McDonald’s Peace Theory is being put to the test. Nations are warring against nations and we struggle to understand our enemies abroad as well as our political foils at home. Meanwhile our economy is still trying to recover from an artificial stop to fight the COVID-19 pandemic, a stimulus (that may have been the right call at the time), and then a second stimulus (that was definitely not the right call). Inflation is back to 1970’s Jimmy Carter levels and stocks are in a bear market.

That’s not good news.

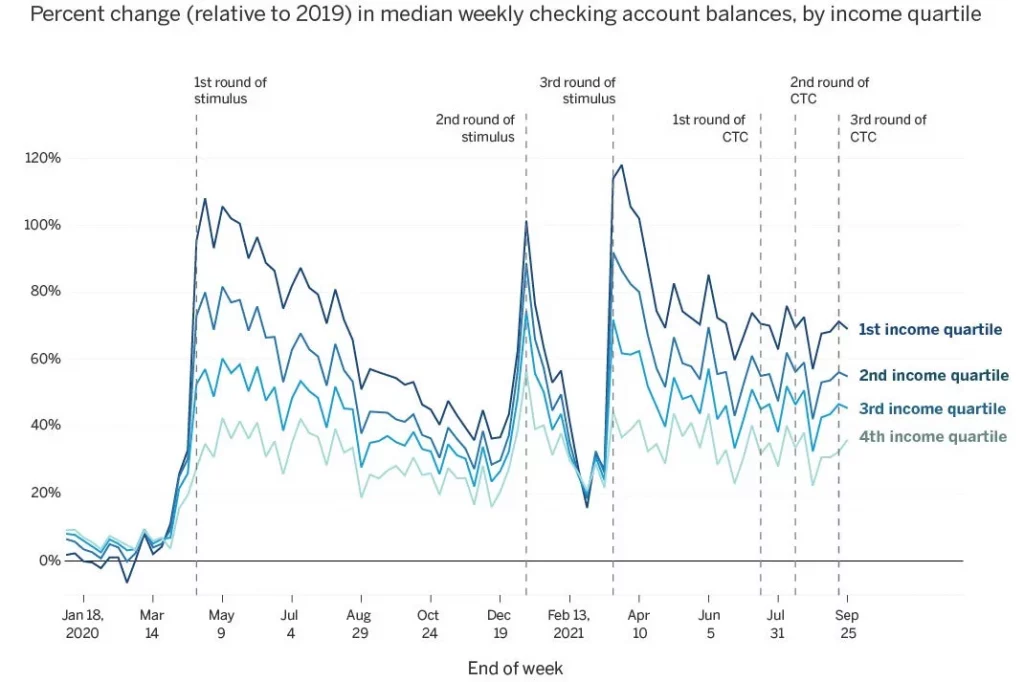

Here’s some good news: We have more cash than we’ve had in a long time.

The personal savings rate in the U.S. is still near 50 year highs and most of us are tempted to hoard that money just in case something worse happens. Whenever our circumstances get bad we are all tempted to get cynical and start waiting for the other shoe to drop. When the market drops we all start fearing it will drop more. When inflation goes up we all start to fear hyperinflation and on and on it goes.

This is why it’s important to have a complete financial plan. Then the question of what to do with all that extra cash is easy to answer depending on what your priorities are.

Is your emergency fund low? Fund it.

Is your high interest debt unpaid? Pay it off.

Is it time to start extra funding for retirement? Invest in your Roth IRA, HSA, SEP, SIMPLE, 401(k), etc.

Are you saving for a house? Sinking fund it.

Do you want to travel to see your grandkids? Spend it.

It’s important to not go “off book” and start winging your financial plan when stuff gets real like it is right now. Decisions made on gut-feelings are not wise especially in the financial realm. Your feelings aren’t a good representation of what is true no matter how much you want them to be.

If your gut is saying to hoard cash as a safety net, remember that inflation is eating away your spending power and your real goals may be going unfunded. You may be setting yourself back instead of powering through this bearish time. Look at the facts and stick to your plan.

Join my newsletter and get biblical financial inspiration.

Demland Wealth LLC (“DW”) is a registered investment advisor offering advisory services in the State[s] of OH & IN and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Demland Wealth LLC (referred to as “DW”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute DW’s judgement as of the date of this communication and are subject to change without notice. DW does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall DW be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if DW or a DW authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.